|

[VIEWED 363141

TIMES]

|

SAVE! for ease of future access.

|

|

|

|

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 12-31-06 8:04

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

I had promised that I was going to start my own thread regarding stock investments and the markets. So many things have happened since last time I was here and I really do not feel like sharing my knowledge. But a promise is a promise and there have been few people that have emailed me and supported me. This thread will deal with investing in the stock markets. I will not discuss individual stocks but discuss ETFs like SPY, DIA, IWM and QQQQ. The one good thing about trading ETFs compared to individual stocks is the the ETFs provide instant diversification among similar companies within the same sector. I will post more as we go along, regarding entry-price, profit-target and stop-losses. I do not think that any ETF is good or bad. It is good only if I'm making money and bad if I'm losig money. If you have not been in the market so far, please read this as an information piece only rather than my recommendations. There is risk involved and you should know how much risk to take on any position. Any suggestations, comments and criticisms are welcome as long as it is market related. If this thread gets out of hand and we start discussing off-topics, I'll stop posting. Have a happy new year!!!! May 2007 bring you and your family lots of joys and riches.

|

| |

|

|

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 03-02-07 5:52

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

This week the market had the worst decline in 4 years. It is NOT the right time to try to be brave and buy. I will like to see this market consolidate here or go slightly lower. Everytime the market will try to go up from here we'll see more sellers come in. It might be few months before we can be 100% long. I'd like the market come down to 1300-1320(S&P). Then I'll be bullish. Right now I'll sell any rallies. I closed most of my short positions today as I had a nice profits on those. I'll NOT recommend shorting to most of the people but now Cash is king. I had previously discussed that one of my Sell rules is 1% true selling day when the 3 of the 5 indexes go down about 1% on the same day. Usually when that happens after a run up, it is prudent to sell part of the portfolio. You don't have to sell 100% and go to cash the first time it happens but it is necessary to cut down on the exposure by about 25% each time it happens. If you had followed that 1 rule, you could have saved a lot of money. I was able to get into cash before the massacare. These sell-offs do not appear out of the blue, usually there is internal weakness before the sell-off. If the market goes up before it goes down to 1360, I'll just wait it to get to about 1450 before building my short position. Take a look at the daily chart of S&P for October 1998. This market looks similar to that and we saw a mini-crash in October 1998. I would not be surprised if we see something similar in March-April.

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 03-02-07 7:13

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Before the market crashed in October 87, there was a 4-5% drop in the 3rd week of August and about 8-10% in the fourth week of August. The market rebounded in September and rallied for a month, it was never able to go past the previous high and finally it crashed in late October. Before the actual crash occured, there were few sell-off of 4-5% on a weekly basis. Crashes do not come out of nowhere, there will be medium size sell-off where new buyers will come to the market. When they cannot take it any higher and market goes down, they will start looking for exits and the crash occurs.

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 03-02-07 7:33

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

If you like to see where the market is going, look at Goldman Sachs (symbol: GS), they pretty much run the world economy. Paulson and Rubin were both GS alumni. If GS rebounds and makes a new high, I'll look to buy other stocks.

|

| |

|

|

DUKE1

Please log in to subscribe to DUKE1's postings.

Posted on 03-02-07 8:02

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Sorry Pal- You wish ! being an American. Goldman Sach was pushed out by China in the world's biggest IPO release in the world;Bank of China. The irony is the chinese finance minister daughter did do internship in Goldman sach and Goldman Sach was still licking chinese feet. Ask Paulon who holds U.S treasuries and dollar and what would happend if China dumped it. See now who runs the show. Do agree Goldman Sach is the No1 trading firm. Did you hear about the Carry trade Unwinding it was Chinese, Russians and Japan who bought Yen not Goldman Sachs. Gold man Sach is caught up in what could be a severe bust of subprime mortgage bust. Any ways Mckinsey and Co is better prefferred in terms of job benefits. Best trading Program does belong to Golman Sachs !

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 03-02-07 9:44

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Duke, This is probably the first post where you haven't talked about my religion or something utterly rubbish, So I'll reply. China has as much to lose by dumping US tresuries as US. They have to keep buying US treasuries in order to keep their exports cheap. China has become a bigger player but they are nowhere compared to the US in finance. China's 10% decline was less than what the S&P lost this week. The unwinding of the carry trade was the main catalyst for the major sell-off. I did not bring that up as my reason because even though few people read my posts here, they are not asking much questions and I did not want to mention carry trade and confuse them. I am not sure about the Russians but the Japanese and Chinese do not really want the dollar to depreciate much. Yuan has a positive corelation to Yen. Usually the funds that have a lot of exposure to the carry trade are small funds and they use huge leverage. Some of the funds are going to get bust soon, not Goldman. Not sure how much exposure Goldman has to sub-prime mortgage lenders but if they have a huge exposure the US government/Fed would step in and start cutting interest rates. They are not going to let GS go down. If this sell-off is only because of the effects of carry-trade then it is a huge buying oppotunity. Only time will tell. The reason I mentioned GS is because I did a historical analysis between GS and the market. When GS is outperforming S&P, you can buy S&P when it is underperforming, sell S&P. By the way what makes a person Nepali? If it is Nepali citizenship and passport then I still have those. My parents are both Nepali citizens too.

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 03-03-07 2:14

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

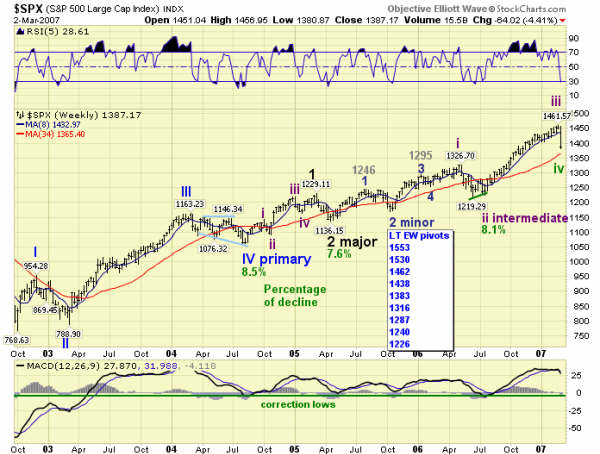

I do not use elliot wave but I follow this one guy's market updates to understand what they are looking at. He posted these targets last year. Look how it went to 1462 and the market sold off. I use these numbers besides my own analysis. The numbers do not necessarily point market turns but it is necessary to be careful when the market approaches those numbers. He thinks this bull market will go to atleast 1530 eventually. He could be right. But for now, I think 1316 is the near target before the market rallies.

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 03-04-07 8:18

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

I understand that there could be none here that trade regularly but most of the people that own stocks/mutual funds are probably long-term investors. So what does last week's market action mean to you? THIS IS IN NO MEANS A RECOMMENDATION BUT THIS IS WHAT I WOULD DO. The main goal of any investor should be capital preservation. Capital appreciation comes second. If I do not have chips then I can't play the game so my chances of winning are nil. There is still some time and I'll take my money out of 50 - of the portfolio. Right after I do that the market might stage a huge rally and I'll feel like a loser for selling at the bottom but that's part of the game. Right now it is necessary to protect what I have, than making money. It will be weeks to months befor we see a bottom.

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 03-04-07 8:20

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

|

|

| |

|

|

prachandra shamsher

Please log in to subscribe to prachandra shamsher's postings.

Posted on 03-04-07 1:54

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Hey eminitrader, good going! You mentioned goldman sach several times, it has gone down below 200 from high of 220. Is it safe to buy it?

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 03-04-07 3:29

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Prachanda: I will not buy anything right now even GS. 90% of the stocks go up or down with the market ie. when the market is good they go up when it is bad they go down. Right now the market is bad so even the good companies are going to go down. Save your cash right now, we'll find lots of opportunities in few weeks or months. Your best strategy is to make a list of good stocks that you'll like to buy. when the market bottoms in few weeks, see how much they declined compared to S&P. If they declined less than S&P, buy those otherwise don't touch it. I will post here when I feel the bottom is near. But right now I'm looking at S&P around 1320.

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 03-04-07 4:01

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

One of the my favorite artist. http://jackjohnsonmusic.com/videogallery/

|

| |

|

|

Danger

Please log in to subscribe to Danger's postings.

Posted on 03-04-07 4:54

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

|

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 03-04-07 8:00

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

There is red all across the board. S&P futures trading at 1379 right now, 6 points below Friday's low. It has already traded about 40,000 contracts. that's a big volume for a Sunday. Usually when the market opens way high or low from the previous close, I like to take the opposite side with small stop. Most of the time it does not work but when it does the payoff is huge. This is strictly day-trade. Long-term I'm still bearish. http://finance.yahoo.com/intlindices?e=asia

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 03-04-07 8:03

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Sorry I meant medium term bearish. Long-term bullish.

|

| |

|

|

prachandra shamsher

Please log in to subscribe to prachandra shamsher's postings.

Posted on 03-04-07 9:18

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Emitrader, Thanks for your Yahoo Asian links.Everything looks red. This may be the sign that further blood bath may occur on monday to us stock market. I watching a stock "FFH", which seems to be going up against the market.Any comments?

|

| |

|

|

prachandra shamsher

Please log in to subscribe to prachandra shamsher's postings.

Posted on 03-04-07 9:24

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Emitrader thanks for your yahoo link. This may be the sign that us market will see more blood bath on monday. Quriously enough, I had been following the stock"FFH", which seems to be going up against the market.Any comments/suggestions?

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 03-05-07 5:51

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Like I said yesterday, the market opened lower but staged a rally. It was mostly short covering rally and gave up the whole thing at the end of the day. I am selling any rallies here. I think there is some more downside to go before we resume the uptrend. Not sure when that will happen (likely to be last week of March) but I'm keeping my eyes open. Here are some books that will be helpful in your journey to make money. How I trade for a Living. How I made 2 million in stock market. The Richest man in Babylon. Fool and his Money. How to be Rich by J Paul Getty. I think this is the end to my active participation here. If someone starts a new thread about trading/investing I'll be happy to contribute.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 03-10-07 2:13

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

thnks eminitrader. been a great pleasure reading your tips.

|

| |

|

|

Net Freak

Please log in to subscribe to Net Freak's postings.

Posted on 03-11-07 10:31

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Keep posting your tips Eminitrader....

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 03-14-07 1:51

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Looks like this sell-off is done. It is time to buy now. Will post picks later today.

|

| |