|

[VIEWED 27166

TIMES]

|

SAVE! for ease of future access.

|

|

|

|

|

|

nepal_ko_lato

Please log in to subscribe to nepal_ko_lato's postings.

Posted on 07-14-11 9:52

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

How to invest in gold in USA? Where to buy? Which Quality gold? Is it legal to buy and store gold? Please share your experiences. I remember NAS had mentioned about investing in gold in today's economy, but I couldnt find that thread.

|

| |

|

|

|

|

lll_lll

Please log in to subscribe to lll_lll's postings.

Posted on 07-14-11 11:10

PM [Snapshot: 55]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

This is the time to short gold not invest in it.. mark my words!

|

| |

|

|

harkay

Please log in to subscribe to harkay's postings.

Posted on 07-15-11 10:57

AM [Snapshot: 271]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

I am using Apmex.com. Go for the bars not the coins since coins cost more to mint.

|

| |

|

|

tyrannyoflogic

Please log in to subscribe to tyrannyoflogic's postings.

Posted on 07-15-11 11:02

AM [Snapshot: 280]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

wow shorting gold??? thats a first and bold...whats ur argument? u talking short term?

|

| |

|

|

harkay

Please log in to subscribe to harkay's postings.

Posted on 07-15-11 11:17

AM [Snapshot: 293]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Avg Gold Prices in the last 15 yrs:

1996 - $388

1997 - $331

1998 - $294

1999 - $279

2000 - $279

2001 - $271

2002 - $310

2003 - $363

2004 - $410

2005 - $445

2006 - $603

2007 - $695

2008 - $872

2009 - $972

2010 - $1224

2011 - $1451

Today: $1590

Source: http://www.kitco.com/

|

| |

|

|

IT_Guy

Please log in to subscribe to IT_Guy's postings.

Posted on 07-15-11 11:22

AM [Snapshot: 305]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Nas Bro, Can you provide more info about "Bank Vault" ?

Do we need to open account for that ? What is the procedure ?

Do bank of Amercia or some common bank have this tyoe of facility ?

Can you provide the website link if you have ?

Thanks in advace Bro.

Last edited: 15-Jul-11 11:24 AM

|

| |

|

|

harkay

Please log in to subscribe to harkay's postings.

Posted on 07-15-11 11:38

AM [Snapshot: 331]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

IT_Guy ... Most banks is USA provide "Safety Deposit" boxes. A 3x5x22 box is usually around $15-$20/yr at small banks. Larger banks like Bank of America can charge upto $50.

For example:

5x5x22 - $20/year

3x10x22 - $25/year

5x10x22 - $35/year

10x10x22 - $50/year

Some banks will give you free safety deposit boxes if you keep atleast $5000 - $10,000 or above in your checking/savings acct. So the price of a safety deposit box will depend on the Bank.

|

| |

|

|

lll_lll

Please log in to subscribe to lll_lll's postings.

Posted on 07-15-11 12:21

PM [Snapshot: 385]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

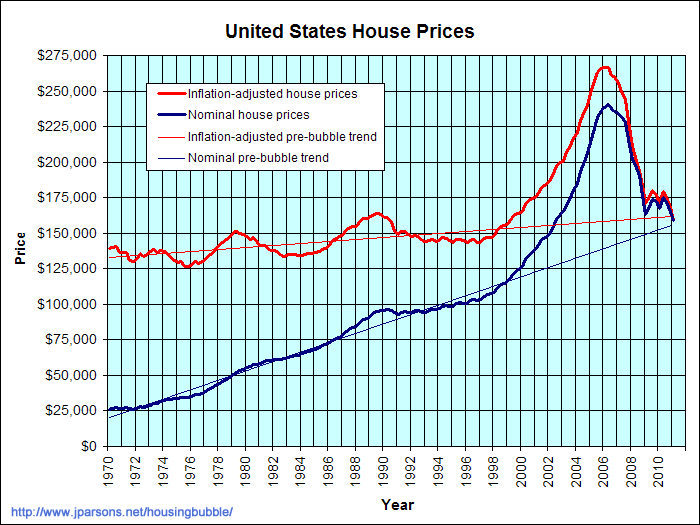

The numbers harkey should provide an indication. Does it look or sound familiar? Here is a BIG hint!

|

| |

|

|

tyrannyoflogic

Please log in to subscribe to tyrannyoflogic's postings.

Posted on 07-15-11 12:31

PM [Snapshot: 391]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

seriously........ housing bubble??? gold is a commodity(rare metal) which is getting scarcer by the day ...debt ceiling...weaker dollar ...inflation ...how can u jst disregard all these and put up a housing bubble chart......yeah the bubble theory might work in a LONGER long term but for the current long term i wouldnt dare be in the short side of gold or even any commodity for that matter

Last edited: 15-Jul-11 12:39 PM

|

| |

|

|

chaurey

Please log in to subscribe to chaurey's postings.

Posted on 07-15-11 1:18

PM [Snapshot: 454]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

what are you guys talking about? in leyman's term please :(

|

| |

|

|

problems101

Please log in to subscribe to problems101's postings.

Posted on 07-15-11 4:04

PM [Snapshot: 570]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

SO nas bro,

you say its not too late to invest on gold eh? How long you think before we see some return of say 30%

|

| |

|

|

wonton

Please log in to subscribe to wonton's postings.

Posted on 07-15-11 4:05

PM [Snapshot: 571]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Nas can you provide some detail on where to buy gold and where to deposit it? How are you doing it if you don't mind sharing.

|

| |

|

|

problems101

Please log in to subscribe to problems101's postings.

Posted on 07-15-11 4:06

PM [Snapshot: 579]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

ani f1 student le gold ma invest garda huncha??

|

| |

|

|

ihateamerica

Please log in to subscribe to ihateamerica's postings.

Posted on 07-15-11 4:56

PM [Snapshot: 623]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Nas,

A quick question. How much of gold can we carry to Nepal. Do you have any idea?

|

| |

|

|

cajunboy

Please log in to subscribe to cajunboy's postings.

Posted on 07-15-11 5:52

PM [Snapshot: 663]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

To last poster, Change your fcking username.!!

|

| |

|

|

lll_lll

Please log in to subscribe to lll_lll's postings.

Posted on 07-16-11 10:32

AM [Snapshot: 774]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Yeah, seriously dude!! I am seriously talking about a housing bubble to draw a correlation between housing market and gold. Do you think it matters whether a bubble is in housing market or a commodity? Remember tulip mania in the 1500's? Just because it is a commodity does not mean that a bubble cannot happen, in fact it is much easier in the commodities market because the intrinsic value of gold is much harder to determine rather than the intrinsic value of things such as house or a car, in terms of dollars. Yes, in LONGER long term (in long term we are all dead, as Keyens said) the prices of house and gold will always go up. It is the Longer short term or Shorter short term that you have to worry about.

Debt ceiling? Really? Do you think that they are not going to come up with a solution? Really???

Weaker Dollar? Maybe it has some way to go but so has other currencies around the world? Remember everything is relative. What is the dollar going to fall against? Euro - It has its own problem. Yuan - It is pegged. Yen - maybe.

Inflation? Don't be a sucker and apply what you learnt in the school as is. Market does not look at inflation but inflation expectation and it is already baked into the current price of gold. In the event of QE3, which I believe is highly unlikely in current senario because it does not have enough political apetite, yes it is possible otherwise, inflation is a non-issue at this point.

Smart money has already left Gold. Now all you have is late entrants and speculators left. My personal cue was Soros hedge fund selling all their gold position a month or so back. We make our own personal decision. I have made mine sold my position to make a nice profit. If you seriously think that gold is going to go up by 50% or 100% from here, then gold might be for you. For me, I am done with gold, for now.

|

| |

|

|

tyrannyoflogic

Please log in to subscribe to tyrannyoflogic's postings.

Posted on 07-16-11 11:24

AM [Snapshot: 791]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

US dollar used to be backed by gold ...how is that for intrinsic value!!! They ran out of gold to back the dollar up or the price of gold rose too much ...so they got rid of that system ...and yeah they had to print more money Everyone and their mothers know that the government is gonna raise the debt ceiling by any means which is the main kicker for gold prices to go up ...what solution are they gonna come up with...not raise the debt ceiling and have the government shut down? The dollar is going to fall against itself..it wont be worth as much as it is today or against commodities ...it wont buy as much of commodity as it will now Do we really know how much of the inflation expectation is baked into the current price of gold? Yes I agree QE3 doesnt have enough political appetite as of now ..but have u seen the current recession curves compared with the previous ones...I would expect a QE4 too by looking at those curves.. Any equity or commodity does not go up in a straight line, there will be pullbacks, profit taking and corrections along the way ...maybe soros was taking profits before anyone else did and then picked it up at the bottom again

|

| |

|

|

lll_lll

Please log in to subscribe to lll_lll's postings.

Posted on 07-16-11 12:27

PM [Snapshot: 837]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

As you go back and re-read by post, I have in no way said that gold does not have intrinsic value. I have merely said that the intrinsic value of gold is very hard to determine in terms of dollars. The key words are: Very hard and in terms of dollars.

So, what is going to happen after debt ceiling is increased? Especially if it succeeds to include the debt reduction methods? I believe the dollar is going to go up? no?

Dollar is going to fall against itself does not have any meaning. What is it going to fall in relation to is the big question. As Einstien has pointed out a decade ago, nothing can exist in isolation. As long as dollar is better investment than anything around it, there will and always be a flight to dollar, it does not matter if dollar is worth a crap, it will still be the best crap around.

No, we do not know how much inflation expectation is baked into the gold but we do not know either how much actual inflation is going to occur. We use the best model we have to predict with the given level of money supply. The importance here is not the specific but the way things are priced in the market.

I will be the first one to agree that we do not know multitudes of things. We make decisions based on incomplete information. Who know what the real level of inflation is going to be? Who knows what the European debt crisis outcome is? Who know if George Soros Or John Paulson is adding to or selling like crazy the gold protfolios they have. As I said, I made my personal decision based on the timing and amount of investment I had. Maybe gold will skyrocket and be around $3,000 dollar a year hence. I have made a decision that I think is rational with the amount of information I have. I you believe this is wrong, you can and should invest more in gold. This is what makes markets function. Good luck investing in Gold!

|

| |

|

|

sidster

Please log in to subscribe to sidster's postings.

Posted on 07-16-11 1:53

PM [Snapshot: 897]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Big dogs like Buffett and Soros are unloading their gold and silver positions. These people have histoy of making the right calls more often. All i have to say is "Be careful about going all in GOLD at these levels. When Buffet was selling his Stock positions in 2006 and 2007 people thought he was crazy but it all made sense his SELLS two years later.

http://blogs.wsj.com/marketbeat/2011/05/04/soros-fund-selling-gold/

Great story in this morning’s Journal on how some of the savviest investors in the world have been positioning themselves around the precious metals boom. Perhaps the most interesting bit is how George Soros’ fund has been easing out of the gold trade. Gregory Zuckerman and Carolyn Cui report:

While many who buy gold do so to protect against future inflation, Soros Fund Management bought gold to protect against the possibility of the opposite — debilitating deflation, or a sustained drop in consumer prices.

But now the $28 billion Soros firm, which is run by Keith Anderson, believes chances of deflation are reduced, eliminating the need to hold as much gold, according to people close to the matter.

People familiar with Mr. Anderson’s thinking said he believes the Federal Reserve’s continuing to pump money into the system has reduced the likelihood of deflation.

The Soros team, meanwhile, isn’t especially worried about a surge in inflation. Mr. Anderson has argued that by the end of this year the Fed will signal that interest-rate increases are in the offing, possibly early in 2012, according to someone close to the firm. Higher interest rates would tend to suppress inflation.

The Soros fund has sold much of its gold and silver investments over the past month or so, according to this person.

Here is another link:

http://www.marketwatch.com/story/soros-is-selling-his-gold-should-you-too-2011-06-06

Buffet also sold his Silver positions and here is what his take is on GOLD

“Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

and another:

“You could take all the gold that’s ever been mined, and it would fill a cube 67 feet in each direction. For what that’s worth at current gold prices, you could buy all — not some — all of the farmland in the United States. Plus, you could buy 10 Exxon Mobils, plus have $1 trillion of walking-around money. Or you could have a big cube of metal. Which would you take? Which is going to produce more value?”

|

| |

|

|

lll_lll

Please log in to subscribe to lll_lll's postings.

Posted on 07-19-11 10:37

PM [Snapshot: 1298]

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

I will be waiting to be corrected then...

|

| |